The Only Guide to Paul B Insurance

Some Ideas on Paul B Insurance You Need To Know

They can be appealing since they have reduced costs. Usually, individuals with these sorts of plans do not recognize that the plan they have actually purchased has more limitations than standard health insurance coverage, which their plan will not actually cover the services they need. Individuals with this kind of protection can still be seen at UCHealth-affiliated facilities.

Minimal Advantages and also Practitioner/Ancillary Only plans are not constantly very easy to determine and the cards these strategies give to their participants are usually complex. Minimal Benefits Strategies go by numerous names, including, yet not restricted to: minimal benefits strategies, practitioner-only strategy, physician-only strategy, etc. Minimal Advantages Strategies likewise often use a method called "unilateral rates," which indicates the plan attempts to determine to a health center or doctor just how much they ought to be spent for supplying health and wellness services to their members, although the plan does not have a contract with the healthcare facility or medical professional.

Additionally, Minimal Advantages Strategies might tell their members that they can most likely to any kind of health center they want or use any kind of medical professional they pick, but that does not imply that the strategy is in-network with UCHealth. Wellness Shares are deal minimal coverage and also repayment for restricted services. To put it simply, they pay very little for extremely few kinds of services.

Paul B Insurance - Truths

Though Wellness Shares might feel like medical insurance, they are not. Typically, patients with these types of strategies do not understand that the strategy they have actually acquired is not health and wellness insurance coverage, which their plan won't really cover the services they need. Patients with this kind of "insurance coverage" can still be seen at UCHealth-affiliated facilities, however we do not obtain previous authorizations or bill them on part of individuals.

If the individual intends to look for repayment from their Health and wellness Share, they will need to deal with the strategy straight. If people need an in-depth declaration of their services, or else recognized as an Itemized Declaration, individuals can submit an Itemized Declaration demand online or contact us. Wellness Shares are not constantly easy to determine, and the cards these plans offer to their members are typically confusing.

Occasionally the strategy cards do clearly state that the plan is not health and wellness insurance. In Addition, Health Shares might tell their members that they can most likely to any kind of healthcare facility they want or utilize any kind of medical professional they select, but that does not mean that the plan is in-network or approved by us.

The Paul B Insurance Ideas

Some insurance plans need members to make use of details labs, or to acquire a referral or consent prior to specific types of treatment.

Cathie Ericson Sep 27, 2020 When choosing a medical insurance plan, it is very important to understand just how much you may need to pay of pocket each year.

You'll get discount rates for other things as well like eyewear, orthodontics and also healthy and balanced consuming programs. You can even save on baby products and medspa solutions. You'll likewise have coverage with Help America, just in situation something happens while you're traveling away from house.

The Buzz on Paul B Insurance

So, you're never greater than a telephone call or click away from aid, whether you're at house or on the move. When you're selecting a medical insurance plan, it is essential to recognize it will fit your demands. If you require aid, use the Prepare for Me device. You can utilize the device to contrast choices and estimate your care and prescription expenses based upon your circumstance and also health and wellness needs.

The links listed below discuss the cost savings account types. You likely have several even more inquiries when you're choosing a new insurance policy plan.

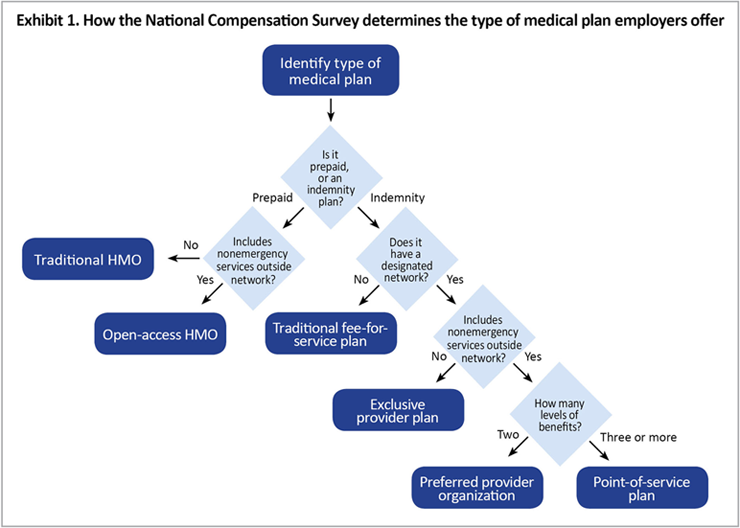

If you're purchasing a wellness plan, odds are you've found the terms HMO, PPO, as well as EPO. While there are several kinds of health insurance plan out there, these are amongst the most commonly acknowledged. Here's a quick testimonial of their functions to help you determine which kind of strategy might be right.

Top Guidelines Of Paul B Insurance

Network service providers are the doctors, other wellness care companies, and also healthcare facilities that a health insurance agreements with to offer clinical care to its members. These providers are called network companies or in-network service providers. A carrier that isn't acquired with the strategy is called an out-of-network provider. Depending on which kind of strategy you pick, you might be required to use in-network providers, or you might be free to go outside the network for treatment.

Look our provider network A PCP is the doctor you see for the majority of your standard healthcare demands. A PCP concentrates on preventive treatment as well as treating routine injuries as well as health problems as well as might recommend that you go to an expert when needed. Relying on the sort of plan you pick, you might be needed to pick (or designate) a PCP to offer and also collaborate your treatment.

With an HMO plan, you have to pick a PCP. Your PCP will give appointments and also regular care and also issue referrals when you require to see a specialist. You'll need to utilize medical professionals as well as medical facilities that remain in the strategy's network. Out-of-network services are covered just for immediate care and also emergency situations.

The smart Trick of Paul B Insurance That Nobody is Talking About

PPO represents Preferred Company Company. With a PPO strategy, you can visit any kind of doctor or health center in or out of Discover More Here the network without a recommendation. site here You'll pay less when you utilize in-network physicians and also hospitals as well as pay even more when you make use go now of out-of-network ones. For more detailed info, reviewed What is a PPO? With a PPO strategy, you're covered when you utilize suppliers both in as well as out of the network.

With a PPO strategy, you are not needed to choose (or assign) a PCP. If you do, they will offer as your individual physician for all regular and also preventative health and wellness care solutions. You will certainly save money utilizing an in-network vs. out-of-network PCP. PPO plans use a few of the biggest flexibility of all health and wellness plan types.

You typically have a minimal amount of time to choose the ideal health insurance coverage prepare for your family members, but rushing and selecting the wrong insurance coverage can be pricey. Here's a start-to-finish guide to aid you discover budget friendly medical insurance, whether it's with a state or federal industry or with a company.

Facts About Paul B Insurance Revealed

If your employer provides medical insurance, you won't need to make use of the government insurance coverage exchanges or marketplaces, unless you wish to search for an alternative plan. However plans in the marketplace are likely to cost even more than plans offered by companies. This is since the majority of companies pay a section of workers' insurance coverage costs.

By restricting your choices to service providers they've contracted with, HMOs do often tend to be the most affordable type of wellness strategy. A benefit of HMO and also POS strategies is that there's one primary doctor managing your general healthcare, which can result in greater experience with your requirements and continuity of medical documents.